AI / REGULATION

FTC backs off an order against an AI startup, citing a Trump directive

The FTC just hit “actually never mind” on an order against an AI startup, pointing to new direction from the Trump playbook.

Translation, the guardrails are getting rearranged mid-drive, and anyone budgeting for compliance is now staring at a moving target like it owes them money.

Question for reader: If regulators start giving AI firms a longer leash, do CFOs loosen controls too, or double down because the fallout still lands on finance?

CYBER / FRAUD / RISK

Fraud attacks expected to surge in an AI “perfect storm”

Fraud experts are basically screaming “2026 is the year of impersonation,” because AI made it way too easy to fake voices, emails, invoices, vendors, and apparently reality.

Great time to find out your approval workflow is held together by vibes and a Slack thumbs up.

Question for reader: What is your actual anti-impersonation control, beyond “our AP manager has good instincts”?

FINANCE TECH / DEALS

OneStream to go private in a $6.4B takeover to move faster on AI

OneStream Software is going private for $6.4B, with the usual pitch: fewer public-market headaches, more speed, more AI capability.

CFOs who rely on these platforms now get to watch a core vendor change incentives overnight. Fun.

Question for you: When your finance stack goes private, do you expect better innovation, or higher prices with a nicer press release?

TAX / AP / COMPLIANCE

New 1099 thresholds and crypto tax forms are testing AP departments (survey)

AP teams are getting dragged into 2026 with new 1099 thresholds and crypto tax paperwork, and the survey vibe is basically:

this is a time-eating compliance monster.

Filing thousands of forms is already brutal, now toss in crypto forms and pretend your timeline didn’t just combust.

Question: Are you treating AP compliance as a cost center to squeeze, or as an operational risk you actually staff like you mean it?

TAX / POLICY / COSTS

Treasury projects a 3.2% rise in business tax preparation costs

Treasury says business tax prep costs are rising again, which is a polite way of saying,

“Congrats, your finance team gets to spend more time proving you did taxes correctly.”

Monetized time cost is the ultimate CFO insult, it’s literally pricing your pain.

Question: Do you attack this with automation, outsourcing, or by cutting complexity at the source even if it annoys the business?

TALENT / LICENSING / PIPELINE

New Jersey Senate passes a CPA licensing bill

Another state moves on CPA licensing changes, because the pipeline problem is now too loud to ignore.

The profession is basically trying to solve a talent shortage while also insisting standards can never change, which is an impressive level of cognitive gymnastics.

Question: Would you rather have more CPAs faster, or fewer CPAs with tougher gates, if it means audit and close capacity stays tight?

ACCOUNTING / CONTROLS

Beyond Meat hires a new CAO amid an accounting overhaul

Beyond Meat brought in a new CAO while it tries to clean up reporting after identifying a material weakness.

This is the corporate version of saying “we’re fine” while quietly calling in a structural engineer.

Question: When you see a CAO hire during an overhaul, do you assume the fix is underway, or that the real mess is bigger than what’s been disclosed?

EXEC MOVES / CAPITAL MARKETS

Navan’s CFO is leaving in January after a big IPO year.

Post-IPO CFO exits always trigger the same group chat questions:

planned transition, burnout, board politics, or something else hiding in the footnotes.

Question: Is a post-IPO CFO exit a normal baton pass, or a signal that the public-company grind is already breaking the story?

GOVERNANCE / LITIGATION

Judge reconsiders ex-Starbucks CFO as a defendant in the ‘Triple Shot’ case

A judge granted a motion to reconsider the ex-Starbucks CFO as a defendant for certain claims, calling dismissal “procedurally improper.”

CFOs everywhere just felt their personal risk meter spike one notch, because apparently the job can follow you home, legally.

Question: Are boards doing enough to protect CFOs from becoming the liability sponge, or is this just part of the comp package nobody reads?

FINTECH / LEADERSHIP

Marqeta names a new CFO, a Stripe and JPMorgan alum

Marqeta hired a new CFO with Stripe and JPMorgan DNA while it pushes profitability.

That usually means one thing, less “growth story,” more “show me the margin.”

Question: When fintech swaps in a profitability-leaning CFO, do you expect smarter discipline, or a creativity freeze that slows the business down?

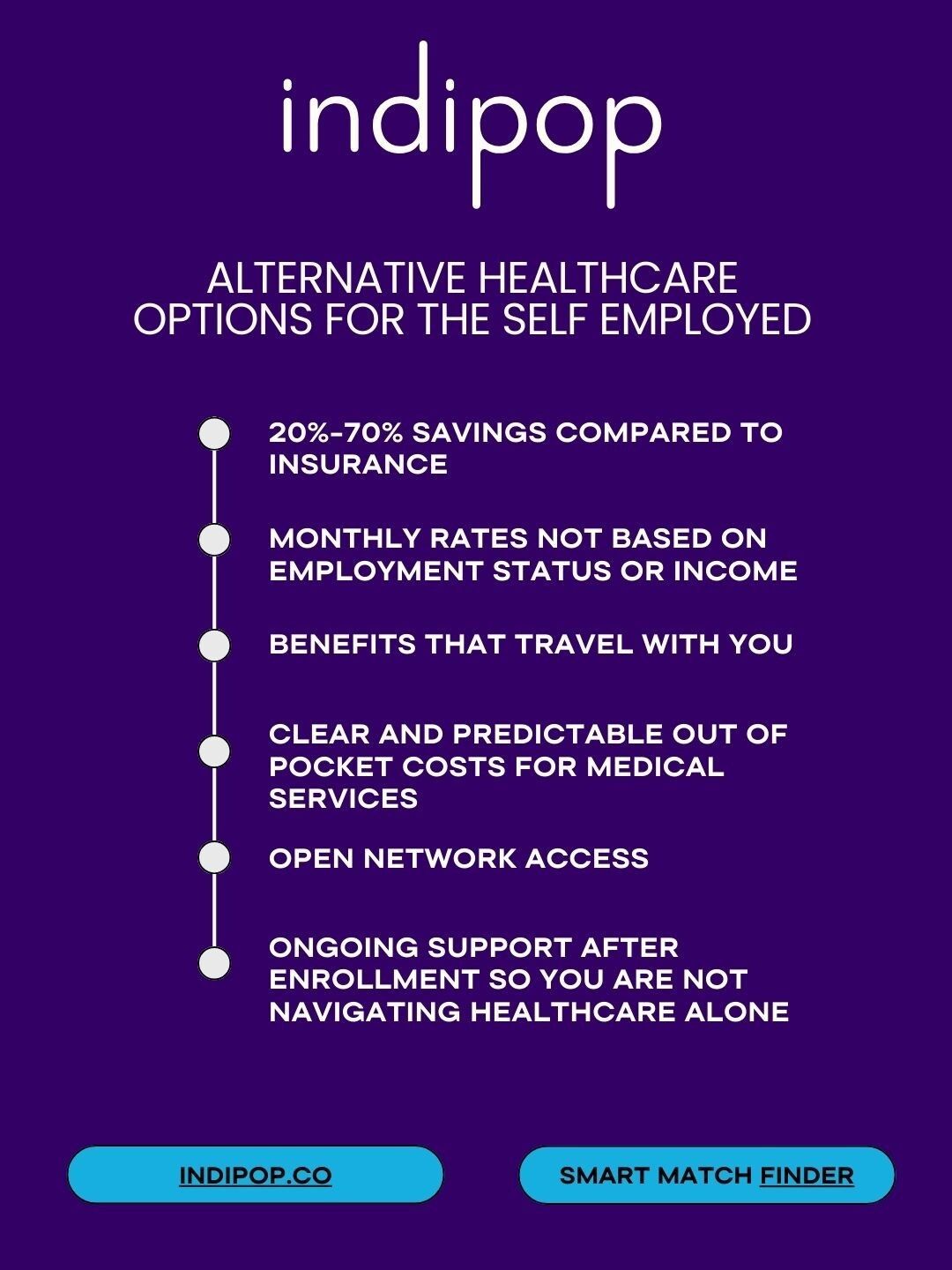

Save 20%–70% compared to traditional insurance

indipop is a marketplace for curated, membership-based healthcare designed for today’s independent and mobile workforce.

Members can save 20%–70% compared to traditional insurance, with transparent monthly pricing not based on employment status or income.

With year-round enrollment, an open nationwide network, and benefits that travel with you, indipop puts you in control.

From everyday care to surgeries and emergencies, costs are predictable and clear, no surprise bills, just simpler healthcare that works around your life.

Contact CEO Melissa Blatt for a free consultation Zoom call.

Brought to you by..

Valuation, Not Just Revenue

Many founders still assume revenue equals valuation. CFOs know better.

Matteo Turi (CFO, board director, and advisor on $500M+ in capital raises) has built a practical framework that explains what investors actually underwrite: transferable value.

His High Valuation Code breaks valuation down into three levers CFOs can influence directly:

IP monetization

Succession and governance depth

Scalable, repeatable expansion models

The framework is built from real transactions across SaaS, healthcare, energy, and infrastructure; not startup folklore.

If you’re advising founders, preparing for capital raises, or thinking beyond top-line growth, it’s worth reviewing.